| SWW | ||||||

|---|---|---|---|---|---|---|

| Delivery Start | Notes | Basis | Cash Price | Delivery End | Basis Month | Futures Price |

| Club Wheat Max 10.5% | ||||||

|---|---|---|---|---|---|---|

| Delivery Start | Notes | Basis | Cash Price | Delivery End | Basis Month | Futures Price |

| HRW 11.5% | ||||||

|---|---|---|---|---|---|---|

| Delivery Start | Notes | Basis | Cash Price | Delivery End | Basis Month | Futures Price |

| DNS 14.0% | ||||||

|---|---|---|---|---|---|---|

| Delivery Start | Notes | Basis | Cash Price | Delivery End | Basis Month | Futures Price |

| Barley (Coast) | ||||||

|---|---|---|---|---|---|---|

| Delivery Start | Notes | Basis | Cash Price | Delivery End | Basis Month | Futures Price |

| CANOLA FOB UTOWN 9-10-25 | ||||||

|---|---|---|---|---|---|---|

| Delivery Start | Notes | Basis | Cash Price | Delivery End | Basis Month | Futures Price |

All grain prices are subject to change at any time.

Cash bids are based on 10-minute delayed futures prices, unless otherwise noted.

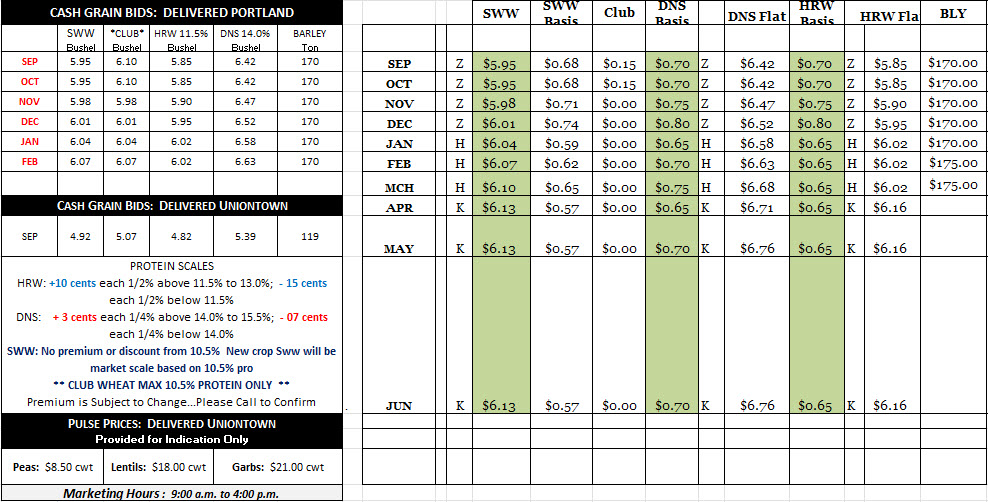

HRW: + 5 cents each 1/2% above 11.5% to 13.0%; - 10 cents each 1/2% below 11.5%

DNS: + 3 cents each 1/4% above 14.0% to 15.5%; - 7 cents each 1/4% below 14.0%

SWW: + 0 cents each 1/10% below 10.5%; - 0 cents each 1/10% from 10.5% to 12.0%. Max = -$0.00

** CLUB WHEAT MAX 10.5% PROTEIN ONLY **

Premiums and Discounts are Subject to Change...Please Call to Confirm

Sept 17, 2025 Market Email: https://s3.amazonaws.com/media.agricharts.com/sites/2446/Markets_AM_09_17_25.pdf

Wheat futures are trading lower this morning, down 4 to 7 cents in the D-E-C 2025 futures. Yesterday's markets got a boost with the idea that we might be close to a trade agreement with China. Scott Bessent, the US treasury secretary said a meeting between President Trump and the Chinese Prime minister, XI will be held later this week after they work out the details of the tiktok deal. The US is delaying the deadline for a deal on the tiktok issue, so the site will not go dark in the US right now. Hopefully the discussions on a trade deal will include some benchmarks for agricultural trade and not just be another pushback of the deadline (currently november 10). US currency values have been dropping as well, adding some strength to our ability to attract export business. Speculative traders got involved with some short-covering yesterday and the markets are giving some of that back this morning.

Monday's crop progress report showed both corn and soybean G/E ratings fell 1% to their seasonal lows. Corn harvest advanced 3% to 7% and soybean harvest showed up at 5%. WEather continues to be hot and dry to push the crop along with concerns the soybean moisture will be deja vu of last year. There isn't anyu major updates in the wheat world to talk about as any trade news gets corn or soybeans excited. We did see export inspections bounce back strongly this week. Winter wheat planting was up 6% this week to 11%, 2% behind the average. Spring wheat harvest is virtually wrapped up at 94% with ID, MT, ND, and WA left to finish up.

Cash Futures Prices: Chicago D-E-C is down 6 at 527. KC D-E-C is down 7 at 516 and MPLS D-E-C is down 4 at 572. US Dollar is trading 0.08 higher at 96.72.

Effective July 1st, 2025

We know every dollar counts, especially in agriculture, and that's why I'm delighted to announce that the Board of Directors has approved a 10% reduction in wheat handling rates. This will bring the rate down from 15 cents to 13.5 cents per bushel, effective July 1st, 2025.

This decision was made with you, our valued members, at the forefront. We firmly believe that by reducing these rates, we can help put more money back into your pockets and support the vital work you do every day on your farms. This is about strengthening our co-op together, and ensuring we continue to provide the best possible value for your hard-earned dollar.

Thank you for your continued loyalty and for being such an integral part of our co-op community. Your success is our success, and we're committed to doing everything we can to support you.

Sincerely,

Garrett Egland

General Manager

Futures Table

- Soybeans Slide Continuing on Thursday Morning

- Soybeans are trading with Thursday AM losses of 3 cents. The market posted 6 to 7 cent losses in the front months at the close. Preliminary open interest was up 13,847 contracts on Wednesday. The cmdtyView national average Cash Bean price was down 5 1/2 cents at $9.67. Soymeal futures...

- Wheat Seeing Some Buying on Thursday Morning

- Wheat is trading with slight gains in the winter wheat contracts on Thursday morning, as spring wheat is weaker. The wheat complex gave back some of the Tuesday gains, with contracts falling lower across the three markets on Wednesday. CBT soft red wheat futures posted 5 to 6 cent losses....

- Cattle Look to Thursday Trade, as Beef Continues Decline

- Live cattle futures were down $2.35 to $2.65 across the front months to close out Wednesday. Preliminary open interest showed a rotation of ownership, up just 388 contracts. Cash trade has yet to get kicked off this week. A few Southern sales were being reported at $239 on Wednesday. Wednesday...

- Hogs Look to Thursday After Wednesday Weakness

- Lean hog futures eased back lower on Wednesday, with contracts down a nickel to 60 cents. Preliminary open interest was up 2,072 contracts. USDA’s national base hog report from Wednesday afternoon was reported at $106.71, up 42 cents from the day prior. The CME Lean Hog Index was down 14...

- Cotton Falling Early on Thursday

- Cotton price action is down 25 to 50 points early on Thursday morning. Futures were weaker on Wednesday, with contracts down 37 to 53 points across the nearbys. The US dollar index was up $0.392 on the day to $96.640. The Fed cut rates by 25 basis points, as expected...

- Corn Showing Steady Trade on Thursday Morning

- Corn price action is steady so far on Thursday morning, with some fractional losses. Futures closed out Wednesday with losses of 2 to 3 cents across the front months. Preliminary open interest was up 10,403 contracts on Wednesday. The CmdtyView national average Cash Corn price was down 2 3/4 cents...